Employee Benefits | Designed to help you Save & Retain Top Talent

Employee Benefits with Coverage for your

Employee Benefits Strategy designed to help you save money and retain top talent!

Finding Great Employees is hard... Keeping them can be even harder!

An Employee Benefits Package can attract and retain the team you need!

Employee Benefits Plans have been our primary focus for as long as we've been in business. This means is we're dedicated to getting you the plan that best suits the needs of your employees and your business. Not only will we shop around between the carriers we work with, but we'll also make sure your plan works for you in a way that will save money and ensure your employees are happy with the ease of submitting claims.

Employee Benefits help you hire and retain the best members of your team

Here's how yourEmployee Benefits Plan Should Work

Determine what your Business needs

Figuring out what your Business needs most is absolutely necessary to determine the best Employee Benefits Strategy for your Business. We go through a strategic Needs Analysis to determine exactly which plan and which provider works best for your Businesses needs, and budget.

Design an Employee Benefits Strategy

Once we've determined what you're looking for, we choose from a panel of insurance companies. We're a broker after all, we don't have preference to any company. Each business is different and deserves coverage from the company that can serve it best. We work with several insurance companies to ensure that your Business is getting the coverage it needs.

Begin Implementation

Whether you're starting out fresh or changing your Benefits Provider, it's important you work with an agency that reflects the values of building relationships on all levels of your Business. We're here working with you to ensure successful implementation of your new Benefits package. We'll be there every step of the way to help you and your employees.

Let's take a look

Components of your Employee Benefits Plan

Your Employee Benefits Insurance Plan has multiple components. For the most part this includes coverage for Health and Dental expenses, but depending on the plan you choose for your team, there can be so much more.

Health and Prescriptions

Dental Expense Coverage

Life Insurance and AD&D

Critical Illness and Disability Coverage

Health Spending Account

Retirement Savings Plans for your Team

Here's What our Valued Clients Have to Say About Our Insurance Policies

Garrett Thienes

Rochelle Duzan

Anne Marie Fitzgerald

Matthew Gourley

Meg Davis

Stella Sehn

The latest information

Life & Health Insurance Articles to keep you informed on the latest Industry trends.

Juvenile Insurance – It’s Never Too Soon for Guaranteed Insurability

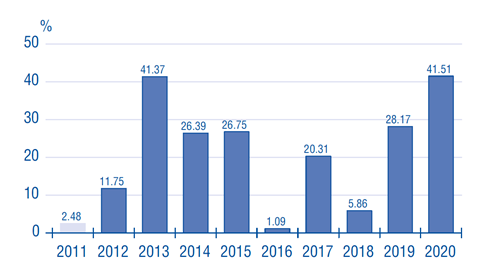

The Cost of Waiting

Cheap Term Insurance or Free Life Insurance

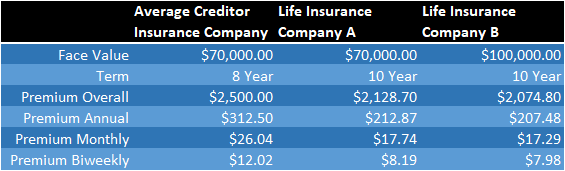

Creditor Insurance vs. Life Insurance

Family Protection with Whole Life Insurance

Choosing a Broker for your Group Benefit Plan

The Link Between

Find more great articles on our new 'Link Between' Webpage!

The Link Between is a planning resource website designed to help you plan for your financial future and understand the role of insurance in your life. With regular content additions, you can subscribe to get regular updates and stay informed about the latest news in insurance and investments.

Your most commonly asked questions about Employee Benefits

Years in the field have given us the tools to find you the Business Group Benefits Solution for your Business. If you don't find an answer to the question below - give us a call! We're more than happy to help!

It really depends on the needs of the business and its employees. Since small businesses can range anywhere from 1 employee to dozens of employees. The type of benefit plan best suited for a small business is one that suits the needs of the employees without creating budgetary issues for the company.

A simple Health Spending Account could be the answer for a group of people who don’t have many health expenditures. Meanwhile a larger group might have people with families who require a little more, so have a complete health & dental package might be a better option.

In any case, we can help you find the right plan for your business.

Different Components of the group benefit plan are taxed in different ways. The only portion of the group plan that is completely tax-free is the health & dental coverage. Extended Health Care, Vision Care, Dental care and Health Spending Accounts are not a taxable benefit when the premium is paid by the employer.

Life Insurance, Accidental Death & Dismemberment and Critical Illness are a taxable benefit and the premiums paid by the employer are added to the employees T4.

As for Disability, the premiums are tax free if paid by the employer, but if this is done, any claims paid to the employee are taxable as income. On the other hand, if the employee pays the premium as a deduction on their payroll, the premium is a taxed as income. However, in the event of a claim by the employee, the claim payments are not taxable as income.

No. There is no legal requirement for a company to provide a group benefit plan to its employees. However, providing a health plan to employees is a good way to add to employee’s compensation without having to pay too much tax.