Planning for Retirement with Investments in Medicine Hat

Investments from the Big Four Financial Groups

We Work to Find You the Best Return on Your Investment

Maximize your Return on Investments. Your RRSP's will never look Better!

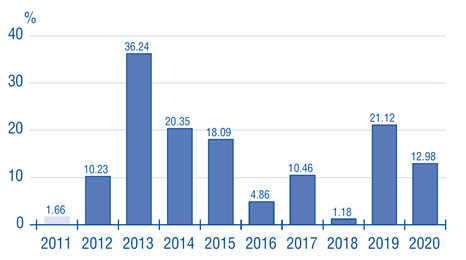

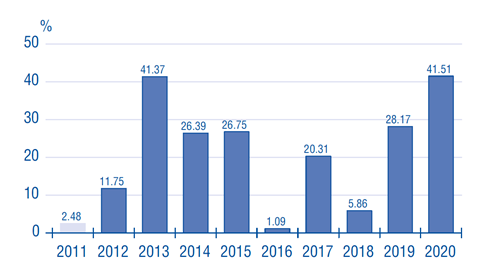

Ask about our Investment Funds. We work with the best Financial Institutes in the Industry to find Funds which perform better than any other in the industry. Watch your Investments grow by an average of 12% over the next ten years!

Protect your Investment

Here's how ourRetirement Planning Strategy works

Analyze Your Current Financial Situation and Your Future Needs

We will sit down with you and take a look at your current financial health. You let us know where you need to be and when you need to be there. Determining your financial needs will help us decide the best way to manage your assets so you can make an informed decision about how to move forward.

Design an Investment Strategy

Using the many investment funds from the Investment Managers in the Country, we'll put together an effective strategy for your all your investment vehicles. We'll make sure you have the registered accounts you need to maximize your retirement fund.

Start Putting your Money Away

Whether you're starting out fresh or adding to your existing portfolio - It's important you work with an agency that reflects the values of building relationships on all levels, top to bottom, to successfully implement your new Retirement Investment Strategy.

Let us help you get a plan in place now so you can relax later.

We'll Find you Investment Funds that Outperform the Rest!

Whether you're setting up your first RRSP or converting a Pension into a LIRA

We've been working with Fund Managers from the best companies around and we've seen what they can do. Clients who moved their RRSPs and other retirement plans with us over the past few years have seen growth like never before.

The latest information

Investment Funds & the Medicine Hat Marketplace

Juvenile Insurance – It’s Never Too Soon for Guaranteed Insurability

The Cost of Waiting

Cheap Term Insurance or Free Life Insurance

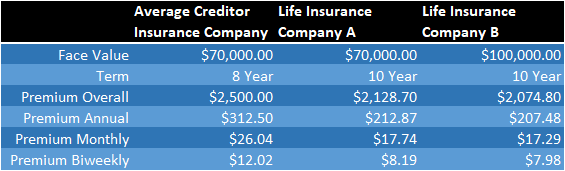

Creditor Insurance vs. Life Insurance

Family Protection with Whole Life Insurance

Choosing a Broker for your Group Benefit Plan

Your most commonly asked questions about Investment Funds Medicine Hat

Years of working with retirement plans have given us the tools to find the best solution for you. Here are some answers to the most commonly asked questions below, but please, call us if you want to find out more!

We do not charge a sales fee.

Our Sales team has no interest in making money from your investment. We already receive a commission from the Investment Group, so why would we try to muscle in on your money? We’re here to make you money, not the other way around.

The Investment Funds do have a Management Expense Ration(MER) Fee associated with them which ranges between 1-2.9%. We can take a look at the options and find the fund which suits your risk rating and gives you the best return to offset these fees.

We work with nearly 40 different companies to make sure we find you the best products.

Some of the main Groups we’re contacted with include:

- Manulife

- Sunlife

- Industrial Alliance

- Canada Life

There’s no right answer to this question. These products work well for certain people depending on their financial situation.

Mutual Funds typically have a lower Management Expense Ratio (MER), but also a lower Rate of Return (RoR). You should expect to pay about 1% MER on a Mutual Fund. Anything more than that should yield a Higher RoR

Segregated Funds tend to have a much better RoR, but also come with a higher MER. An added bonus is that they tend to have lower risk factors.

Lower Risk + Higher MER = Beter RoR