Travel Insurance to Give your Peace of Mind

Getting Travel Insurance has never been this easy!

Taking care of your round trip...

Travel Insurance from Bolton Insurance is quick to set up and can save you money!

When making a trip anywhere in the world it is important to consider what might happen if you had a medical emergency. If you’re travelling within your own province it’s not a as big a concern because you’re covered by your provincial health plan. Outside of province, however, you’ll encounter the concern of paying a hospital bill. Medical fees here in canada aren’t usually a huge expense if you are covered under a company health plan or a personal one, but what about if you’re over seas? Does your health plan cover this? Can you afford to cover it?

Thankfully getting a medical emergency travel policy is relatively inexpensive. You can usually cover yourself for up to a month for less than $100 depending on age and health status.

As well, you can get coverage for trip cancellations and baggage loss for an extra fee. So if you’re transporting something valuable of there’s a chance you’ll have to postpone your trip, you can avoid expensive fees to recover the situation.

Our Plans help you with the one thing you want most - peace of mind!

Learn about the different options you have forTravel Insurance

Emergency Medical Travel Insurance

Most Importantly, when travelling outside of your province make sure you have coverage to pay for your expenses in the event of a medical emergency. It's easy to set-up and relatively inexpensive. It is offered by most travel agents as part of the trip, but if you decide to look around for something more inclusive or less expensive, we can help.

Trip Cancellation & Interruption Coverage

Trip Cancellation Insurance can be expensive, so it definitely makes sense to determine whether you need it. The premium is based on the cost of your trip and typically costs hundreds of dollars or even thousands if it's an expensive trip. If you've booked a trip costing you less than $4000 and your departure date is within a few weeks, it may not be worthwhile for you. You may find better value in an All-Inclusive Travel Insurance plan.

However, if you've planned a trip with a departure date more than a few months away, Trip Cancellation Insurance makes more sense. Longer periods of time between planning and departure can often come with a higher risk of cancellations. AS well, if you're spending more than $5000 on a trip you should seriously consider this coverage. Save yourself the pain of losing out on an expensive trip that can no longer be taken.

All Inclusive Travel Insurance Plans

All-Inclusive plans are ideal if you need both medical coverage and trip cancellation coverage. These plans cover you for all the same events as the other plans and you can save some money on the premium. They're less ideal for expensive trips since the trip cancellation component of these plans is capped at a certain amount.

Speak with an advisor today to find out which plan is best for you!

COVID Related Event Coverage

Concerned about travelling because of the pandemic? This plan might put your fears to rest.

We can find you a plan which is tailored in the same way as an Emergency Medical Plan, but also have some extra coverage in the event you encounter a COVID situation. You can travel anywhere in the world and have this coverage even if the travel has non-essential travel only restrictions and it will cover you whether you've been forced to quarantine or if you end up with a COVID Medical Emergency. There is even coverage for those who are not able to get vaccinated.

Multi-Trip Travel Insurance

Are you planning to make several trips over the next few months? A multi-trip plan might be the answer for you. Get coverage all the trips you plan to take over the next few months and pay a smaller premium for the insurance. Trips which are 30 days or less can be covered under this plan.

Annual Travel Insurance

If you're planning to be on the road travelling on a regular basis all year long and you still intend to make it back home in less than 30 days for each trip, an annual plan might be the right plan for you.

The annual plan is good from the day you set it up right through the year and gives you all the same coverage as a single trip Medical Emergency plan for a much lower fee. Best of all, these plans can be set up as a family plan so you can save even more money on all those trips you take with your family outside of province.

The latest information

Travel Insurance & the Medicine Hat Marketplace

Juvenile Insurance – It’s Never Too Soon for Guaranteed Insurability

The Cost of Waiting

Cheap Term Insurance or Free Life Insurance

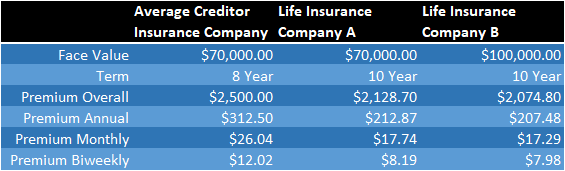

Creditor Insurance vs. Life Insurance

Family Protection with Whole Life Insurance

Choosing a Broker for your Group Benefit Plan

Your most commonly asked questions about Travel Insurance

Years in the field have given us the tools to find you the answers your looking for about your travel insurance areas of concern. We're here to help, so if you don't find an answer to your question - just call! We're more than happy to give you a hand!

Travel Insurance is meant to cover you for the unexpected while you are away from home. The very basic coverage is meant to cover you for your own medical emergencies while travelling. This will ensure you’re not out anything if you get sick or hurt while you travel, but it won’t save you if you need to cancel your trip.

Trip Cancellation/Interruption coverage allows you to cancel your trip in the event of an emergency or travel home sooner than expected at no extra cost.

As well, you can benefit from the advantage of baggage loss coverage if you lose your bags. We’d all like to assume everything will go as planned while travelling, but who can be certain what might happen?

No. You can travel anywhere you want without insurance. Who’s going to stop you?

On the other hand, you might want to consider having the coverage anyway. After all, you never know what might happen to you, your loved ones or even your bags. If you hold any of these things close to your heart, you may want to think about having some sort of coverage.

Like all insurance, travel insurance can be cancelled by the owner of the policy. If you’ve already begun your trip, you may only require to have a portion of your premiums returned when cancelling, since you’ve already been covered for a period of time.

If you’re cancelling the insurance before travelling it may only require your option to rescind the policy. On every insurance policy you have a ten day window to decide that you are not interested in having the coverage. All premiums will be returned by the insurance company.