Life Insurance | Flexible | Affordable Protection

Life Insurance for your

Working with you to find the Life Insurance Policy you Need!

Life Insurance for your family means...

Safeguarding your family with asset coverage in the event of your loss of life.

Our Strategies are designed to protect you and your family in the worst case scenario. We work with the best insurance companies in Canada to ensure you've got the coverage you need at a price you can afford. Sudden loss of life is not something we don't like to think about, but we must plan for the things we can't foresee. In the event of a critical illness or injury you're covered as well. We even offer strategies designed to help grow your investments while simultaneously protecting your from the unexpected. Whether you need to ensure there is enough money to cover outstanding mortgage and debt after you're gone or you simply want to make sure your estate is protected, we have a solution for you.

Designed with your family in mind

Life InsuranceHere's how it works

Determine the needs of you and your family

Determining the needs of your Family is absolutely necessary to find the best Strategy needed to protect your future. We go through a strategic Needs Analysis to determine exactly which plan and which provider works best for you, your family, and your budget.

Your Best Interest is our First Concern

Design a Strategy which suits your needs

Once we've determined what you're looking for, we choose from a panel of insurance companies. We're a broker after all, we don't give preference to any one life insurance company. We work with several insurance providers to ensure that you and your family are getting the coverage you need.

We don't work for the Insurance Company.

We work for you!

Invest & enjoy your new found peace of mind

Whether you're starting out fresh or rewriting an existing plan - It's important you work with an advisor that reflects the values of building relationships on all levels, top to bottom. You're looking for an advisor that values your services for a lifetime. We keep in mind your best interests, your families interests, and your budget.

It's Never Too Soon.

Don't Wait Until it's Too Late

Here's What our Valued Clients Have to Say About Our Life Insurance Policies

Garrett Thienes

Rochelle Duzan

Anne Marie Fitzgerald

Matthew Gourley

Meg Davis

Stella Sehn

Dahlia Mook

The latest information

Life Insurance & the Medicine Hat Marketplace

Juvenile Insurance – It’s Never Too Soon for Guaranteed Insurability

The Cost of Waiting

Cheap Term Insurance or Free Life Insurance

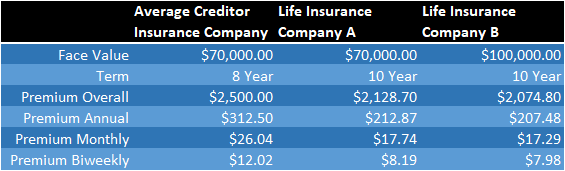

Creditor Insurance vs. Life Insurance

Family Protection with Whole Life Insurance

Choosing a Broker for your Group Benefit Plan

Your most commonly asked questions about Life Insurance

Years in the field have given us the tools to find you the best Insurance Policy for you and your Family. If you don't find an answer to the question below - give us a call! We're more than happy to help!

Depending on a persons situation, Life Insurance may or may not be important. To determine the importance of life insurance for each individual, we would assess the financial burdens placed on the surviving loved ones of each individual we consider for life insurance.

We would consider an individual to have a need for life insurance if their financial situation would leave strain on their family members in the event of their passing.

For the most part, beneficiaries who receive a claim settlement from a life insurance policy will not be taxed for the income of that benefit. However, cash values which are paid in excess to policy cash surender values are taxable as gains.

To determine the right amount of coverage and the type of policy needed, each person should sit with an advisor and review their need for a policy based on their overall net value. An assessment of current coverage and assets weighed against liabilities and final costs will help to determine the right policy for each individual.

A Term policy will guarantee a level premium for the length of the term, usually 10 or 20 years. At the end of the term the policy is renewable depending on the age of the individual, but the premiums will be significantly higher since the individual will have aged.

A Whole Life policy guarantees that the premium will remain the same for the duration of the policy or until paid up. The policy remains in effect for the whole life of the individual and cannot be cancelled by the insurance company for any reason other than fraud. These policies tend to have higher premiums due to the nature of the risk taken on by the insurance company, which is why we recommend getting them at a younger age.