The Business Tax Squeeze

You feel the Tax Squeeze when you’re trying to earn a dollar. Increasing property taxes, increasing CPP contributions, increasing minimum wage etc.

You feel it when trying to take money out of your corporation.

You feel it when trying to abide by the TOSI (Tax on Split Income) Legislation.

You feel the Tax Squeeze when retaining earnings to use for passive investments. Increasing taxes due to passive income tax rules and potential reduction in the Small Business Deduction limit.

Most importantly though, you feel the Tax Squeeze in retirement. You feel it when you earn too much taxable income only to have your Old Age Security payment clawed back!

Many of my clients are feeling the Tax Squeeze. They come to me looking for low-risk, established ways to access corporate assets in a tax-minimized fashion during their lifetime. If you’re in a similar position, it may be something to look into.

So, What is a Successful Business Owner to do?

What if there were a low-risk, CRA-conforming way of accessing your corporate retained earnings while minimizing your income taxes both corporately and personally?

We can’t solve all your Tax Squeeze issues, but we can help you deal with a few.

As you might already suspect, it involves the use of life insurance; permanent life insurance to be precise. Here’s how it works:

- Through your corporation, you purchase permanent life insurance on yourself as a shareholder. The corporation is the owner and payor of the policy.

- Ideally, the policy is situated in a Holding Corporation.

- Retained earnings (in addition to minimum premium) are contributed to the policy.

- Extra benefit: the assets are now inside of a tax shelter.

- This minimizes passive corporate income today!

- If a Holding Corporation owns the policy, this can also provide another layer of potential creditor protection

- When you’re ready to create personal retirement cash flow, you can work with your lender or one of our pre-approved lenders and set up a personal line of credit.

- This is secured with the corporate permanent life insurance policy.

- We can usually obtain 90% or more of the total cash value of the policy as a line of credit limit.

- For the privilege of using a corporate asset to secure a personal loan, the shareholder will be assigned a Shareholder Benefit (a percentage of outstanding LoC balance) annually.

- Yes, that amount is taxable, but minuscule;

- Working with your tax professional through the entire process is critical

- Any funds withdrawn from the LoC are tax-free and interest is usually added to the outstanding balance.

- Upon life loss of the insured shareholder, the concept is wound-up, the bank loan is repaid and using the Capital Dividend Account (CDA), usually a substantial amount is still available tax-free to the survivors of the deceased shareholder.

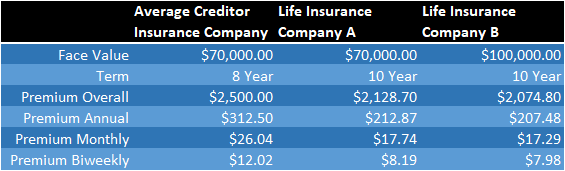

What About Buying Term and Investing the Difference?

So, you’ve heard that buying a term policy and investing the difference is a great alternative concept for corporate wealth creation. In theory it’s a good idea but in most cases the corporate investment would have to earn between 8% to 12% annually (after fees, before taxes) to break even with the corporate insurance strategy.

We can show you Side-by-Side how a corporate passive investment would compare with the permanent life insurance concept both with regards to creating after-tax cash flow as well as net-to-estate funding. This will allow you to put your corporate dollars to work without having to worry about all the tax implications that typically go with it.

Start your journey today! Let’s put together a financial strategy to help you and your business mitigate the TAX SQUEEZE!

Introducing The Link Between!

The Link Between is a planning resource website designed to help you plan for your financial future and understand the role of insurance in your life. With regular content additions, you can subscribe to get regular updates and stay informed about the latest news in insurance and investments.

Categories

- Critical Illness Insurance (7)

- Disability Insurance (7)

- Group Benefits (5)

- Health & Dental (4)

- Investments (6)

- Life Insurance (11)

- Retirement (5)

- Travel Insurance (1)

- Uncategorized (1)